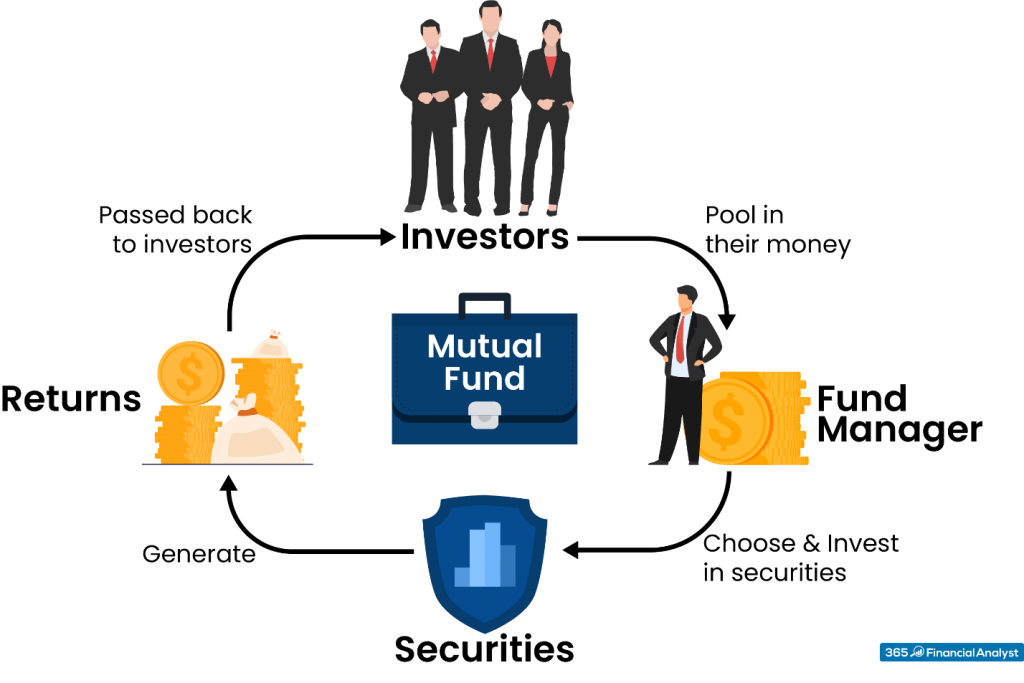

Investing in mutual funds calls for deciding between active or passive management, choosing where to buy funds, understanding fees and sticking to a plan. Mutual fund investors own shares in a company whose business is buying shares in other companies (or in bonds, or other securities). Mutual fund investors don’t directly own the stock in the companies the fund purchases, but they do share equally in the profits or losses of the fund’s total holdings — hence the “mutual” in mutual funds.

Mutual fund definition

A mutual fund is an investment that pools money from investors to purchase stocks, bonds and other assets. A mutual fund aims to create a more diversified portfolio than the average investor could on their own. Mutual funds have professional fund managers buy securities for you.